“Double” Trouble

What does the ethernet, GUI, and laser printer have in common? All these technologies came from the same place. Xerox PARC, a company in the US, is credited with many such groundbreaking innovations. Many of their contributions helped to shape modern computing. In 1970, Larry Tesler, a computer scientist working in PARC, invented 3 elegant commands that drastically improved the computer user experience. The commands: Cut, Copy, and Paste. Imagine a world without these commands. How will you share a document with your friend?

Digital Entities are easy to replicate. Thanks to the efforts of people like Tesler, all it takes is a “copy” command to create a replica of a digital file. What about digital transactions? Can they be replicated so easily? Well, it will take more than a “copy” command, but the fact of the matter is, digital transactions are also prone to replication.

Since digital currencies are, in essence, digital files, any person with sufficient “know-how” can duplicate these files and this will let them spend the same single digital token (or currency) more than once. In technical terms, this is called the double-spending problem. Double-spending makes digital currencies unusable.

Physical currencies don’t have to deal with double-spending. The same person cannot spend the same dollar note twice (obviously). However, in the last session, we talked about a purely digital currency called bitcoin. Since its inception in 2008, the bitcoin payment network has showcased exponential growth. The bitcoin network has well over a million participants and it handles around 360,000 transactions per day. At its peak, a single bitcoin was worth $57,868 (May Vary). But bitcoin is a digital currency, which makes it vulnerable to double-spending. Does it mean that we can replicate bitcoins? If not, how does bitcoin deal with the double-spending problem?

Bitcoin is not the first attempt at creating a purely digital currency. There were other digital currencies like Digicash and Hashcash that came before bitcoin. Bitcoin stands out because it was the first digital currency to solve the double-spending problem in a peer-to-peer manner (without the help of a third party).

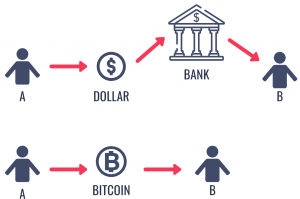

Billions of digital transactions are conducted daily. These transactions use one or the other kind of digital currencies. Whenever someone purchases something online and uses his credit/debit card for payment, he is conducting a digital transaction. So how are these transactions protected from double-spending (replication)? This is where the banks come in. All such digital payments are done via banking networks. The banks are responsible for validating the transactions and making sure that they are not replicated or falsified. Even digital currencies like Digicash relied on such third-party institutions to verify the transactions. But bitcoin is a decentralized digital currency that doesn’t rely on such third parties (as stated in the previous session), so how can they use banks to verify transactions?

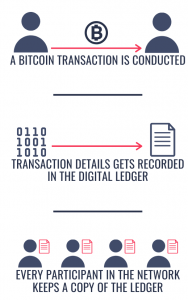

The answer is that bitcoin doesn’t use a bank. Bitcoin solves the issue of double-spending with the help of a digital ledger. This digital ledger records the details of all the transactions that happen in the bitcoin network (from the very first transaction). Once the data gets stored in the ledger, the data becomes immutable (cannot be altered). Instead of storing the transactional data in a central server (like in the case of a bank), a copy of the ledger is shared among all participants in the bitcoin network. So when someone conducts a transaction using bitcoin, each participant can verify the transaction by matching the details of the current transaction with the ones recorded in their copy of the ledger. If they find out that the coins used in the current transaction are already spent in a previous transaction, the current transaction is discarded. Here the participants don’t rely on banks or other third parties for validating a transaction. They do it using their copy of the digital ledger.

No single participant in the network controls the ledger, making it a decentralized ledger and since the copy of the ledger is shared among multiple participants, the ledger becomes distributed. This decentralized, distributed, digital ledger technology is called the blockchain.

Blockchain technology helped solve the double-spending problem in bitcoins, thus making bitcoin a completely decentralized, digital currency. The term “blockchain” was never mentioned in Satoshi’s whitepaper. It was only later that people started referring to this technology like the blockchain.