Enter Satoshi

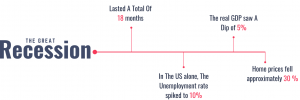

The year was 2008 and the world was going through a rough patch. Accumulation of high-risk loans over the years finally “broke” the financial institutions and this led to one of the greatest economic disasters the world has ever seen (Full Story). Millions lost their homes, jobs, and businesses.

Amidst all this, Satoshi Nakamoto, an anonymous entity released a document titled “Bitcoin: A Peer-to-Peer Electronic Cash System “. Now, to understand the correlation between the paper and the events, we need to take a closer look at the key elements that both the paper and the event dealt with, “Money”(or currency).

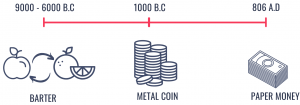

Money has a sizable story of its own. The history and evolution of money parallel that of our society. From the early barter system to fiat and digital currencies, money reflected the ways of how our society worked. After the fall of the barter economy, we had “centralized” authorities (initially as monarchs and later in the form of government) who controlled the value as well as the generation of money.

Soon banks came into the picture and they became our “Trusted Third Party” for conducting financial transactions. We trusted the banks and the banks verified, validated, and coordinated the financial activities on our behalf. Money became an “asset” that was controlled by a “centralized authority” (government) and we relied on a “third-party” (bank) institution to help us deal with it.

These “fundamental” institutions (banks and government), however, came under fire during the 2008 financial crisis. And this prompted Satoshi in devising a new decentralized digital currency (zero central authority for control)Â that can be transacted in a peer-to-peer (zero interplay of third parties) manner. The digital currency was called bitcoin.

With bitcoin, Satoshi wanted to eliminate the reliance on “trusted third parties” and thereby reduce the cost of the overall transaction. Satoshi was also against the idea of sharing “more information than they would otherwise need” for conducting a transaction(source). With bitcoin, Satoshi tried to establish a new form of currency, one that might not lead to a crisis in the future.

But what was so special about bitcoin? How did it remove third party reliance and achieve decentralization?